The Single Strategy To Use For International Debt Collection

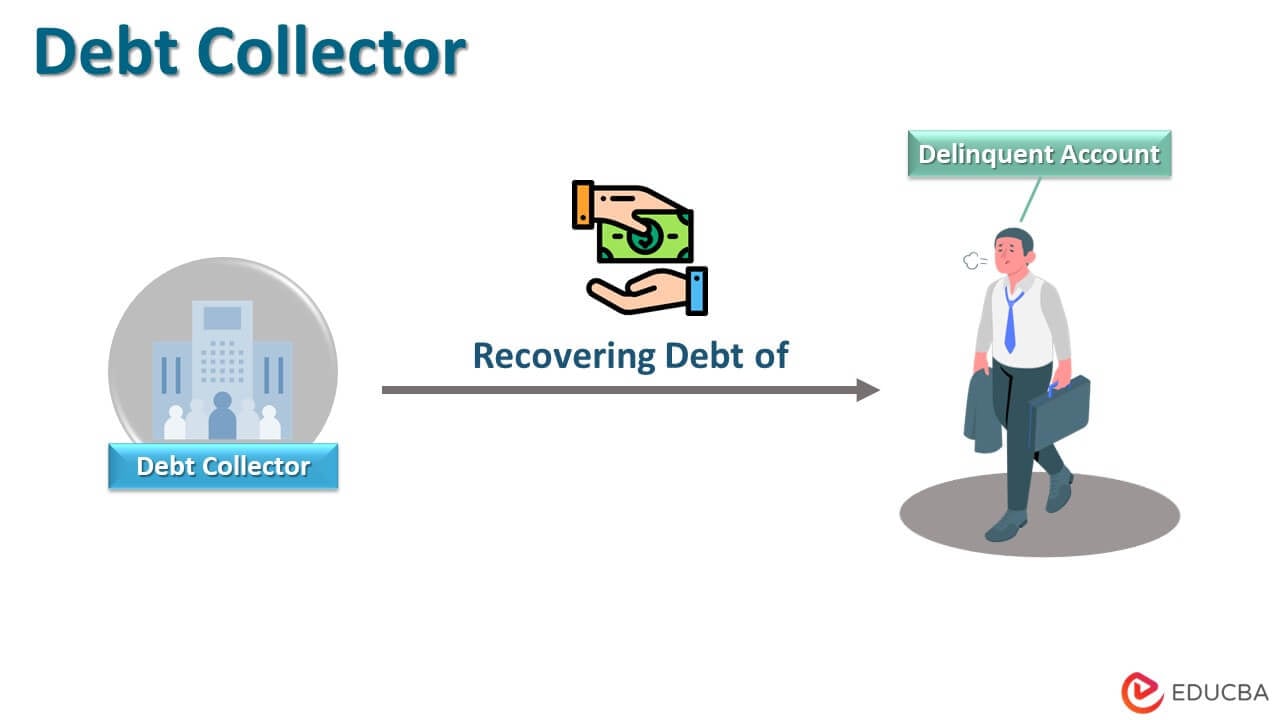

This is the most hands-off technique yet likewise requires that the debt enthusiast take on the most run the risk of. When a collection firm acquisitions your debts, they pay you a portion of the impressive billings.

Employing a debt collection agency might help you recuperate lost revenue from negative financial obligations. Firms must be cautious when hiring a financial obligation collection company to make certain that they are properly accredited, seasoned and also will represent your business well - debt collection agency. Financial debt collection can be pricey, however the amount you receive from unsettled invoices might be worth it

Business Debt Collection Things To Know Before You Buy

Inspect your agreement for a discontinuation clause. If not, contact the company as well as directly bargain such a plan. A termination stipulation can permit you to break the contract by paying a fee or supplying notification within a certain period. There might be a deadline in the agreement by which time you can pass a getaway provision if the agency hasn't delivered.

If they do not follow via on essential points of the contract, you may be able to break the contract. You can additionally simply ask the business what their termination cost is.

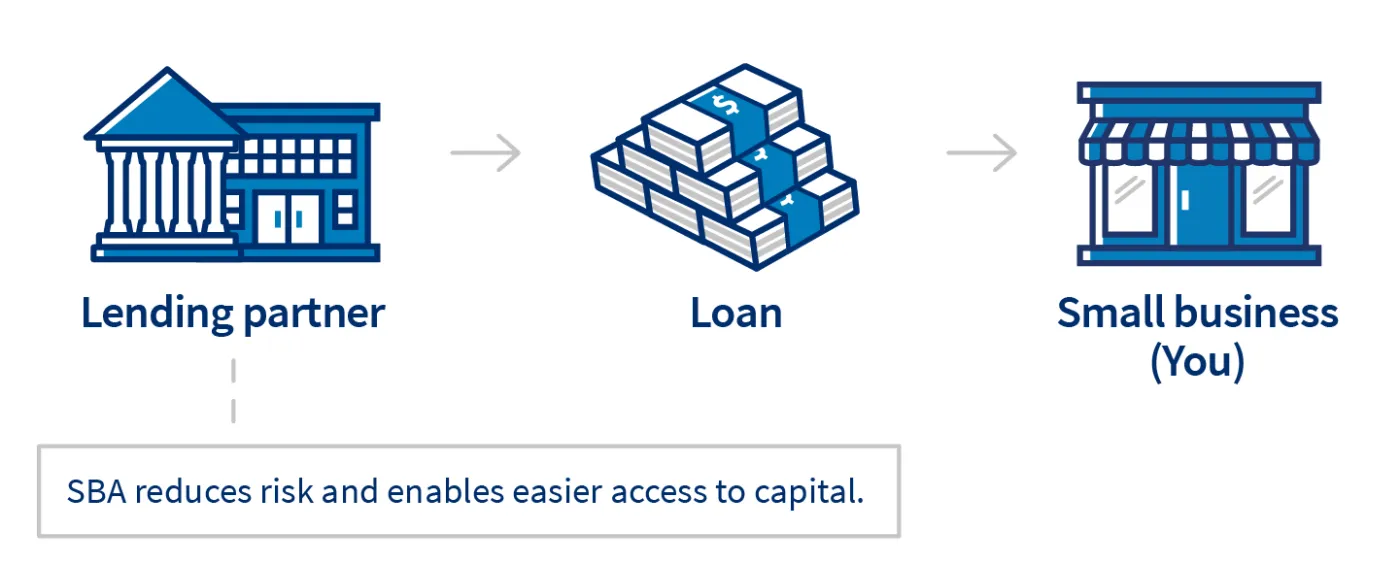

The debt collection sector not just offers an important function in recuperating superior financial debts owed to lenders and solution suppliers, however it likewise provides a level of confidence to lenders to make credit score readily available to a vast range of consumers. It additionally employees a substantial variety of individuals in the united state

4 Easy Facts About Private Schools Debt Collection Described

. When a lender puts accounts with a third Party agency, they are charged with managing the day-to-day tasks of the account. This includes most of interaction and also collection activities linked with these accounts. The status of put accounts within the originating creditor's invoicing or collection systems must indicate that the account is closed/placed.

The Buzz on Dental Debt Collection

At this factor, the financial institution can write off the financial debt as an accounts receivable possession on their annual report because the account is not likely to be paid. The financial institution's annual report looks much better, yet the financial institution still preserves the capability to gather on an impressive asset. Collection agencies deal with behalf of the originating lenders and also try to recuperate unpaid equilibriums by getting to out to the consumer using mail and also telephone.

Agents try to obtain customers on the phone to make settlement arrangements with them, her latest blog either as a round figure to settle the account or through a collection of persisting payments (debt collection agency). Debt collector normally receive a compensation portion on the amount of cash they efficiently gather. This compensation can differ by the age, balance, type and also the variety of times the important site account has been formerly worked, among others

Consequently, later stage collections tend to have a higher compensation rate, since fewer accounts are most likely to pay. The bottom line is the bottom buck. When a financial institution assesses whether to proceed interior recovery attempts versus outsourcing collections to a 3rd party supplier, the lender has to have a strong understanding of the estimated net yield of each method as well as contrast that against the cost of paying payment versus the price of running an extremely specialized, intensely educated group of consumer assistance professionals.

Private Schools Debt Collection - The Facts

Explore our collection of services for financial institutions and exactly how our 3rd party vendor administration can aid you.

A flatmate tells you a financial obligation collection agency called asking for you. That exact same financial obligation collection agency has left messages with your family, at your workplace, and also maintains calling you early in the morning and late at night.

There are federal and also District of Columbia laws that protect customers as well as prohibit debt enthusiasts from utilizing certain techniques that may be violent, unjust, discover this or deceptive to customers. Under these legislations, there are steps that you can require to limit a debt enthusiast's contact with you or for more information about the financial debt collection agency's claim.

:max_bytes(150000):strip_icc()/How-can-i-borrow-money-my-life-insurance-policy_final-fa1474645da94b368bb3f5452392b0c0.png)